Creativity and Innovation best practices at top innovative companies. Innovators creating disruptive innovations in business, technology, social media

Friday, February 24, 2012

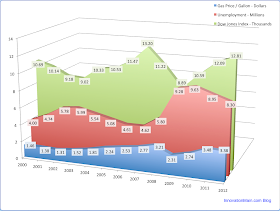

Gas Prices, Unemployment and Dow Jones Index Correlation

Is there a correlation between U.S. gas price, Unemployment rate and Down Jones Index? Shown above are the averages for gas price per gallon, unemployment and DJIA from the year 2000 until now. Can we spot some trends looking back? It appears that every time average Unemployment rate begins to creep up, Dow Jones Index falls. One telling trend was back in 2008, when the average gas price per gallon rose to $3.21 (actual gas prices in some states were well over $4 per gallon), average unemployment rate shot up to 5.80 million and average Dow Jones Index began its slide to 11,220 points after peaking the previous year. Did higher gas prices contribute to higher unemployment and lower stock markets?

Current unemployment rate is around 8.30 million and dropping, which is a marked improvement from 2011. Dow Jones Index has increased simultaneously to an average of 12,810 points. However, the average gas price per gallon has also shot up to over $3.38, and at many places, the gas price per gallon is well over $4.00. Are we going to experience a similar trend as we saw back in 2008, or would the lower unemployment and sustained stock rally mask the sentiment at the pump? An interesting about-face observation is the rise of Dow Jones Index in a direct correlation to the rise in gas prices since 2009. Would that trend continue?

What if the steep rise in gas price continues? If it does, what impact would it have on the unemployment and Dow Jones Index DJIA? Share your thoughts here!